Some years ago, when then Vice President, Professor Gilbert Baalibaseka Bukenya first mentioned the `mafia in government` purportedly against then Prime Minister John Patrick Amama Mbabazi, everyone, including his boss the President, shunned the man. Indeed, in no time, they made him a laughing stock even in public. This, before they staged a CHOGM deal before him, the same that would lead to his imprisonment.

He indeed knew very well, of the existence of `Mafia in government` but never sought any form of counsel, on how to evade them. Today, no one can deny the fact that in Uganda, it is hard to tell who exactly is in charge. We have witnessed presidential directives being shunned, court orders being dust-binned and a variety of legislative orders being laughed off, to mention but a few. All this, but by people you least expect of shunning such would-be powerful instructions! That’s the real world of mafioso.

Yours truly have severally, via my private social media handles, counseled the National Social Security Fund (NSSF) MD, Richard Byarugaba, to let go of the Fund. This stance, after he clocked the retirement age. Like in the Lands` section of this country where, by expiry of any prime property lease around town, someone is already eyeing them, so are the fat contracts like that of NSSF MD. This statement is, honestly, for the knowledgeable and I will leave it at that. Well, Byaruhanga`s job is needed. His time is up and, he has to let go in peace of be helped to do so. But he should avoid the latter at all possibilities available.

Below, we reproduce a strong-worded letter dated December 7th 2022. It is written by the line Minister of Gender, Labour and Social Development, Hon. Amongi Betty Ongom. The letter is addressed to the NSSF Board of Directors` Chairman who, supposedly, had sought the minister`s approval to reappoint Byarugaba. Please read on…

7th December, 2022

The Chairperson

Board of Directors

National Social Security Fund

KAMPALA

DEFFERAL OF APPOINTMENT OF MD, NSSF, PENDING CLARIFICATIONSON EMERGING ISSUES.

Reference is made to yours, dated 30th/11/22, recommending to me the re-appointment of the Managing Director, National Social Security Fund, Mr. Richard Byarugaba. I note that, your justification is based on his performance related to the growth of the Fund over his twelve (12) years tenure and the fact that his weaknesses that the Board discussed with me on Friday, 25th/11/2022, shall be mitigated by strict performance targets.

As you are aware, at this point, we had developed consensus. However, after our meeting at Kapeka yesterday, you note that there were serious issues that has been raised on top of all the other issues I discussed with you severally. In view of the above, the concerns which were raised after the approval of the appointment of MD during the Kapeka meeting, and

other new issues ought to be re-examined by the board and clarity provided before I appoint him as recommended. Further, among the new emerging issues, I would like to know whether in the process of making your recommendation, you considered them, or had prior knowledge or if information about them, and took them into account when making your recommendation.

Performance of the Fund

The justification for your recommendation was largely based of growth of the Fund which is undisputed. However, a thorough examination into it’s performance show decline over the last four years. By all basic measures, the Fund has performed well under his leadership. My focus is a deeper analysis of the actions of the management represented by the MD, which attempts to answer the question: Could the Fund have performed better if the MD had made different strategic decisions?

This is critical because, over the next decade, the role of the Fund in the economic development of Uganda, requires a different mindset change, and different strategic direction. However, the growth rate of the Fund has shown a declining trend, from 32% in 2010 to 11% in June 2022! With a stagnated number of members making contributions to the Fund, despite more factories, construction companies, plantations and industries employing many young people!

Can you clarify why the numbers of contributors have remained stagnate at 630.000 active members with about 690.000 dormant members? Why is the MD not embracing initiatives to scale up registration of more members? Can you avail me his commitment? Over the last years, there has remained constant 2 million registered members out of which 1.33 million have a balance on the system with only 630,000 remitting the monthly contributions. 690,000, remains with dormant accounts, and yet efforts by stakeholders to scale up registration from the current established industrial parks have not yielded result.

Mr. Chairman, what assurances do I have, that at this stage, he will change? This very question was asked by the Chief Coordinator, OWC, during our Kapeka meeting. In fact, for him, he went further to inquire as to who is the BOSS of the other? Management, or The Board and the Minister. It is one of the assignment he gave us to answer. The graph below shows the performance of the Fund between June 2010 and June 2022.

The decline in growth trends may be attributable to a maturing market for the Fund, and that the asset base in the earlier years was much smaller than in the latter years. Either way, it pointed to the fact, that to maintain the growth projectile, the Fund need to identify and cultivate new growth opportunities and register more workers who are majorly employed in industrial parks and at construction sites. A deeper analysis, shows that there have been missed opportunities that could have led to better Fund performance. While using the growth of the Fund as the biggest consideration, did you assess why there has been decline in the growth?

Lack of Strategic Investments in Real Estate

The Chief Coordinator OWC challenged the board to respond to Lack of Strategic Investments in Real Estate! He is right, why? Investments are made to provide a reasonable return to members. So far, the return to members have been from the Fixed income portfolio (Government bonds). A look at the Real estate sector reveals strategic errors that have been costly and have not contributed to the return that members should be getting.

Most real estate projects are marketed way before projects are completed. Most of the management team advocated for off plan sales and commission-based renumeration, that most real estate investment projects undertake. This ensures that, by the time a project is completed, even 80% of the real estate has been offloaded to buyers. The MD, (with his team), ignored that traditional approach to real estate sales. The results may be disappointing in terms of return on investment:

For instance; a, By the time His Excellency, the President launched the opening of the Lubowa Solana 300 homes, no home had been sold. A month later, only 3 are on contract. The pricing strategy for Lubowa is not attractive to middle income Ugandan. Lubowa is supposed to be a project of over 2700 homes (500 acres). If the Fund can’t sell 300 homes in the first phase and over the next few months, will this not be a white elephant project?

Even in Temangalo, (Over 400 acres) where the pricing is more pocket friendly, no house has been sold so far. The reason is, the MD, again with his team, decided that we will not follow the traditional path, but wait until all the units are completed. This in spite of people wanting to sign up now. c, there is a concept that part of the management team floated for both Temangalo and Nsimbe (800 acres). And that was to create a live, play, work mini city. The proposal was to demarcate about 10% of the land and have it designated as export-free zone (10 acres a piece). NSSF would invite various industries to set up operations in these free zones. For the free land, these industries are required to sponsor the establishment of social enterprises like schools, and health centers.

NSSF would then build residential homes around these free zones, and thereby creating a live, work and play mini city. For both sites, the MD did not adopt the recommendation. The value for me remains a key concern, with the cost of houses higher than similar houses within the area.

Lack of, or Limited View of Strategic Direction for the Fund

Mr. Chairman, I have been discussing with you my vision as a Supervisor of the Fund, to present to the Board and Minister of Finance for consideration. I look at the Fund as playing a role of supporting NDPIII. Severally, the Chief Coordinator, OWC, has discussed his proposals at a strategic level with us, and later expressed non-implementation by the MD, you are aware about the details, including lectures at Kapeka and Entebbe. We have not made any concrete proposals on his propositions.

From the many discussions, the question we must ask is: What should be the role of NSSF in National Development? And with the rigid position of the MD, can you assure me that he can deliver on our transformation strategic Agenda? Is he willing to commit to drive our agenda? As you are aware, in 2007, Cabinet adopted Uganda’s Vision 2040 which is “A Transformed Ugandan Society from a Peasant to a Modern and Prosperous Country within 30 years”.

The road to Vision 2040 is being guided by 65-year strategic implementation cycles that have been dubbed the National Development Plans. The 2020/21-2024/25 implementation cycle is the third National Development Plan (NDP III). Based on the review of the country’s performance during the past ten years of implementing the NDP I and II, a number of lessons have been learnt including:

(i) Increasing investment in the ‘real economy’. This economy includes productive sectors in: Agriculture, Industry, ICT, Services, Shelter, Clothing, Health, Education and Security that is able to, generate employment and produce goods for export and import substitution; and (ji), Strengthening the role of government in increasing access to market opportunities in global and regional markets.

The strategic direction and goal of this plan is “Increased Household Incomes and Improved Quality of Life of Ugandans”. The goal will be pursued under the overall theme of Sustainable Industrialization for inclusive growth, employment and sustainable wealth creation. The key objectives of the Plan, among others, are: 1. Enhance value addition in key growth opportunities; 2. Strengthen the private sector to create jobs; 3. Enhance the productivity and social wellbeing of the population; and, 4. Strengthen the role of the state in guiding and facilitating development.

Role of NSSF in National Transformation:

The Fund, which currently has a balance sheet size of UGX17 Trillion ($4.5billion) can, deliberately, support initiatives needed to achieve NDPIII. This can be done without jeopardizing the safety of member funds. For example, 2% of the UGX18 Trillion is equivalent to UGX360 Billion. To ensure safety of member funds, 98% of the assets can continue to be invested in the traditional Government Bonds, Equities and Real estate.

The 2% can be deployed systematically and over time, on the initiatives needed to support NDP I. The advantage of utilizing these funds, is that they form what is commonly referred to as patient capital, and allows the Fund to take a long-term view of any deployment. Furthermore, these funds can be leveraged by partnering with other key stakeholders to increase the pool of funds available. The following are some of the non-traditional initiatives that the Fund is or can be working on: To be continued…

Author Profile

- Stanley Ndawula is a two and a half decades’ seasoned investigative journalist with a knack for serious crimes investigations and reporting. He’s the Founding Editorial Director and CEO at The Investigator Publications (U) Limited

Latest entries

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma

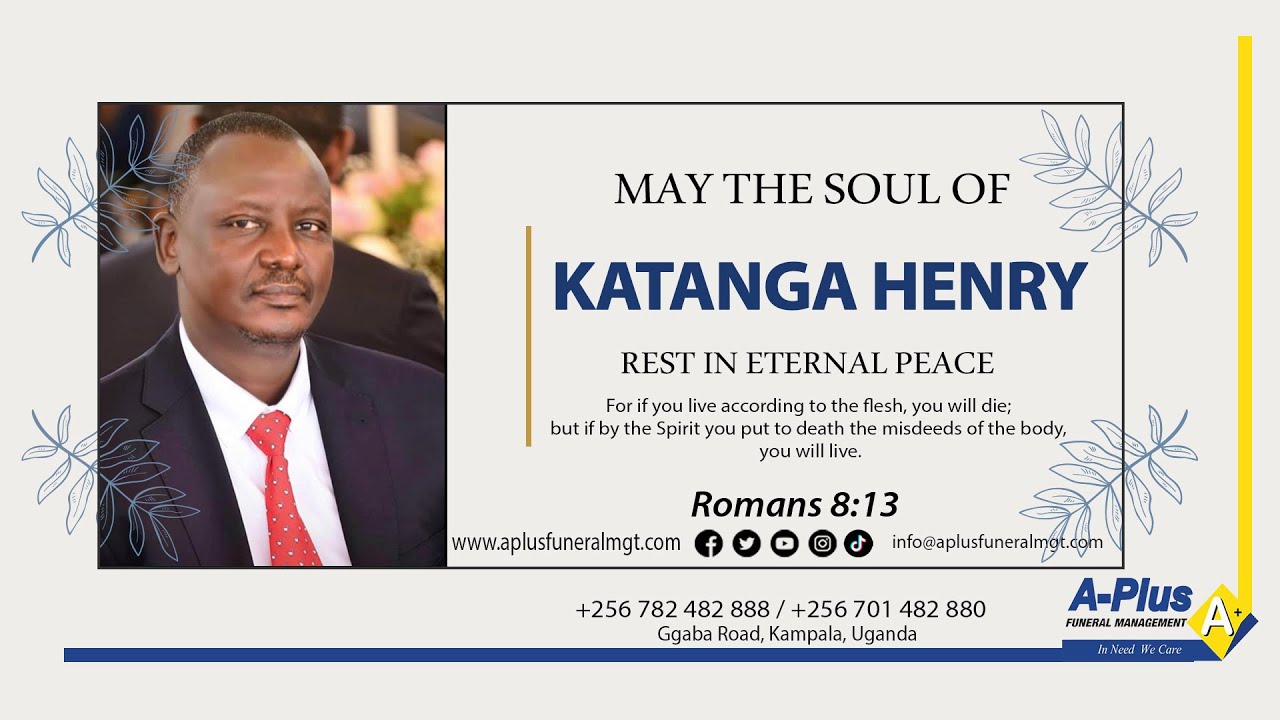

BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account

BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among