The Equity Bank saga continues to unravel as the investigation into a massive UGX65 billion fraud deepens. The latest development sees the resignation and subsequent arrest of the former Executive Director for Commercial Banking, Kenneth Onyango, shedding light on the intricate web of deception within the financial institution.

The saga, which began with the abrupt departure of Kenyan Samuel Kirubi, former CEO of Equity Bank Uganda, in 2022, has now ensnared key figures within the organization. Kirubi, who was ordered to leave office amid mounting suspicions, has since been summoned back to Uganda by Equity Group CEO James Mwangi to confront the fallout of his alleged mismanagement.

Sources within the bank reveal a trail of irregularities dating back to Kirubi’s tenure, prompting a thorough examination of financial records spanning several years. “Kirubi is in the country with auditors from Nairobi. He has been directed by the angry Mwangi to clean up his mess. The auditors, who are being taken around by Kirubi himself, are turning all books of accounts pages from 2018 to when Kirubi left. Many people are yet to lose jobs and others, arrested,” offered our inside source.

The recent announcement by Equity Bank acknowledging the potential fraud on their stock loan and agent financing products sent shockwaves through the industry and the public alike. “We hold ourselves to the highest standards of accountability and transparency, and the person (s) found to be responsible, whether through fraud or errors of commission or omission will be fully addressed by the policies, procedures, and ethical values of the organization and, where appropriate, the laws of the country,” read the statement.

The stock loan product, designed to provide vital credit support to businesses of all sizes, now stands at the center of the investigation. Equity Bank’s commitment to uncovering the truth and holding those responsible to account underscores the gravity of the situation. With both staff and clients implicated in the probe, the bank vows to uphold its standards of transparency and integrity.

The arrest of Kenneth Onyango, once a prominent figure within Equity Bank’s leadership, marks a significant development in the ongoing investigation. Alongside other individuals detained in connection with the fraud, Onyango’s apprehension underscores the severity of the allegations facing the bank.

While Equity Bank seeks to navigate the fallout from this scandal, questions linger over the extent of its impact on both customers and stakeholders. Concerns over accountability and corporate governance loom large as the investigation unfolds, casting a shadow over the institution’s reputation.

We exclusively have it that before the infamous investigation, Mwangi had successfully sought President Museveni`s attention, threatening to close business in Uganda over frustrations in investigations. Initially, all cases for and against Equity Bank Uganda would die prematurely. Some cases` fate would be influenced in Equity`s favor but leaving huge dents on the Bank`s reputation before public.

Indeed, the public is knowledgeable of several outcries regarding this financial facility`s variances in loans given out to their clients. In these pages lies several stories of how the top management at the Bank connived with city businessman Sudhir Ruparelia before they fraudulently sold him two prime properties; Afrique Suits in Mutungo and, Ssimbamannyo commercial facility in the city center

In the midst of these revelations, Equity Bank faces mounting pressure to address the systemic issues that allowed such fraud to occur. With the full weight of the law bearing down on those implicated, the road to redemption for Equity Bank may prove long and arduous.

As the investigation continues to unravel the complexities of this financial scandal, the public remains gripped by the unfolding drama. With each new revelation, the true extent of the fraud at Equity Bank comes into sharper focus, leaving many to wonder how such a breach of trust could have occurred within one of the region’s leading financial institutions.

As the saga unfolds, one thing remains clear: the fallout from the Equity Bank fraud investigation will reverberate far beyond the walls of the institution itself, leaving a lasting impact on Uganda’s financial sector for years to come.

Author Profile

- Stanley Ndawula is a two and a half decades’ seasoned investigative journalist with a knack for serious crimes investigations and reporting. He’s the Founding Editorial Director and CEO at The Investigator Publications (U) Limited

Latest entries

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma

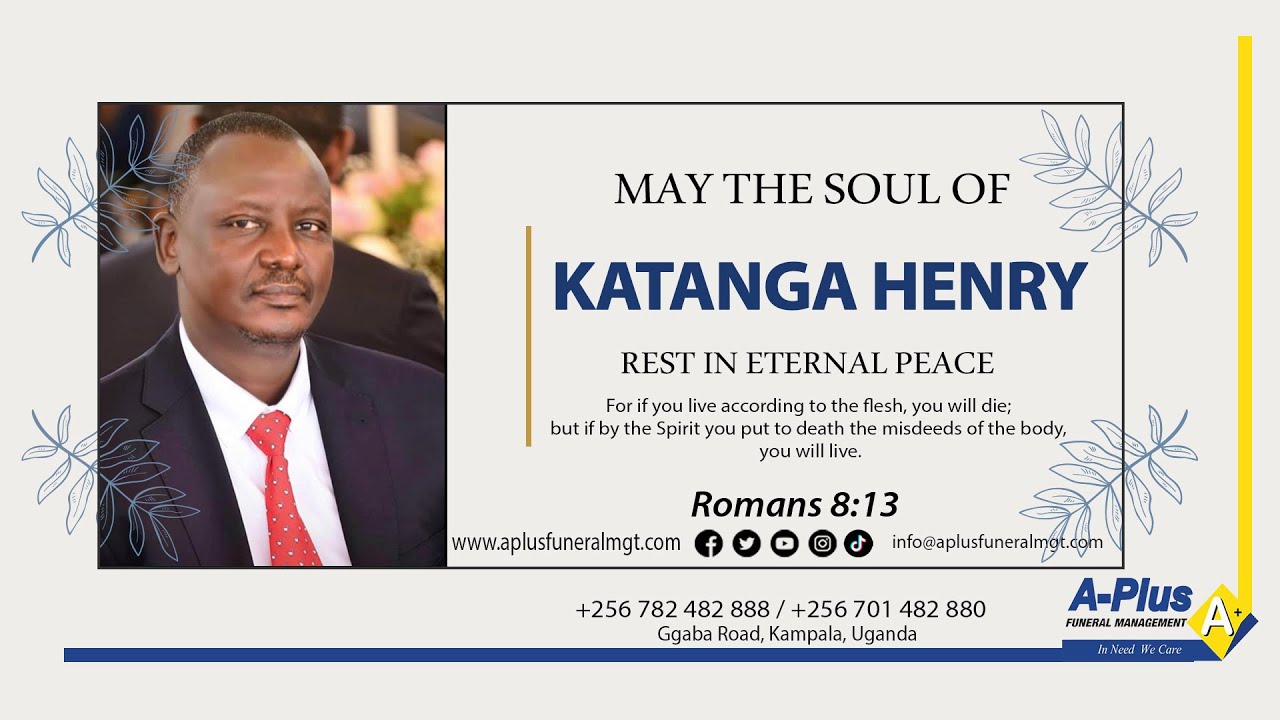

BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account

BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Anelah Milardovich