Bad habits die hard; so, goes the old adage which was first mentioned by the legendary writer Benjamin Franklin in a news article way back in 1758, implying how hard it is for holders of bad habits to let go of their vices. So hard like an effort by a cigar addict laboring to throw away the butt for good.

And upon completion of his investigations that he had conducted as Director of Litigation for the Federal Home Loan Bank, where CEO Charles Keating and hundreds of other S&L owners took advantage of a weak regulatory environment to rob from their own financial institutions, William Black authored a book and rightly named it; “The best way to rob a bank is to own one.”

The above intro fits in well with most privately owned financial institutions` proprietors. In these pages lie several stories on how Dr. Sudhir Ruparelia aka SR, robed clean his Crane Bank, to the tune of warranting Bank of Uganda`s intervention in a bid to save the economy. He had clandestinely designed a way of solely owning the bank through proxies, hence doing whatever he wished with the savers` dimes! More to this later.

Today, we focus on a new entrant, Dr. Paul Kammangne Fokam, the Cameroonian tycoon and owner of Afriland First Bank Uganda Limited, premised along Buganda Road on Plots 7/11. For starters, Fokam is among the unsung filthily rich personas around the African continent and beyond.

His company headquarters based in Switzerland; he also boasts of over 40 branches spread around Africa. He is also a property mogul said to have a string of possessions to his name in all African countries, save for Uganda where, he`s just been introduced. For starters, for a foreign company to own and run a business in Uganda, having a `local content` (read indigenous shareholders), is one of the prerequisites.

Initially, Fokam`s company had two shareholders namely Afriland First Group SA and the man himself. And for him to obtain an operational certificate to run a Bank, Fokam raised the number of shareholders to seven, with a `local content` in Hajji Muyanja Mbabaali. However, the latter was rejected by the Central Bank for a wanting credible persona.

With Hajji Mbabaali`s rejection, Fokam subsequently changed the Company`s shareholding and Directorship status and admitted another Ugandan, Cliff Masagazi as a shareholder/Director with 15{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} shares. It is through Masagazi that the company lobbied and successfully obtained the License to run a financial institution named Afriland First Band (U) Limited.

Other shareholders included Afriland First Group SA with 35{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe}, Afriland Firs Bank Guinea with 13{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe}, Mohamadou DABO with 11.5{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe}, Jean Samuel NOUTCHGOUN with 10{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe}, Samuel Kameugne Soup with 4.5{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} and Dr. Paul K. Fokam the man himself, interestingly with a meagre 1{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} share.

It should be noted that Masagazi`s shares were not only for playing the `local content’ role but also his resourcefulness in doing the donkey`s work of ensuring the general set up of the company, as well as pursuing and obtaining the Banking License from Bank of Uganda. Upon setting off of business on the track, Fokam and group developed second thoughts on Masagazi`s Directorship and shareholding and now wanted him out. Yes, out with empty pockets.

“That however, after a short while, the Company`s Managing Director, a one Hamadou-Hamadou started excluding your Petitioner [Read Masagazi] from involvement in the affairs of the Company without any legal justification. That your Petitioner tried to engage the other Shareholders and Directors to redress his said exclusion but without much success,” reads in part, Court documents in an Appeal before High Court in Kampala.

Masagazi, through his lawyers of Muwema and Company Advocates, filed the Appeal after a questionable ruling by Judge Musa Ssekaana on June 24th 2021, that he had not a single document supporting his claim of the 15{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} shares. This stance, even with the presence of documents from the Registrar of Companies holding him as a shareholder, before Court.

It all started when, after exclusion from the Company`s business transactions, Masagazi wanted to bow out. He wrote asking them to buy him off and leave. But they reiterated by claiming that they owed him not a single coin since his shares were not `officially` paid for! However, our following of this matter landed us on some documents whose particulars expose Fokam as a replica of Dr. Sudhir Ruparelia in the defunct Crane Bank case.

We have landed on an agreement between Fokam and Masagazi, indicating that whereas officially the latter owned 15{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} shares, he was holding 12{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} shares for and on behalf of the former. This development may require the Regulator, Bank of Uganda to revisit the shareholding status at Afriland Bank, to ensure other shareholders are genuinely holding theirs individually, and not on behalf of Fokam who, claim to have only 1{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} share in his own Company.

In the said agreement titled `Deed of Arrangement`, Masagazi is named as 1st Party and Fokam as 2nd Party. “The 1stParty shall continue to hold the shares in the Company in arrangement for the 2nd Party except for 3{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} of the shares which is not the subject of this arrangement and which the 1st Party shall hold and retain to his name as his private property with all rights attached,” reads part of the Deed.

For the avoidance of any doubt, the number of ordinary shares that Masagazi is meant to continue holding on behalf of Fokam is 5,163,097,505.4. “And for all intents and purposes, the 2nd Party shall not lay any legal claim to the said 3{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} of the shares which belong to the 1st Party,” further reads the agreement which, in our view, might attract serious attention from Regulator, BoU.

In this agreement, whose particulars are entirely in total abuse of Financial Institutions Act, Masagazi had to “sign a transfer form of shares for the 12{0945c2a372ac1e8bbfe7cc3e10f9b82eb0b8ae872b07368d754f0396b6ef2afe} shares in the Company in favor of the 2nd Party which shall be kept by the 2nd Party as his security for the interest until that time when it will be appropriate to transfer.” Watch this space…

Author Profile

- Stanley Ndawula is a two and a half decades’ seasoned investigative journalist with a knack for serious crimes investigations and reporting. He’s the Founding Editorial Director and CEO at The Investigator Publications (U) Limited

Latest entries

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma

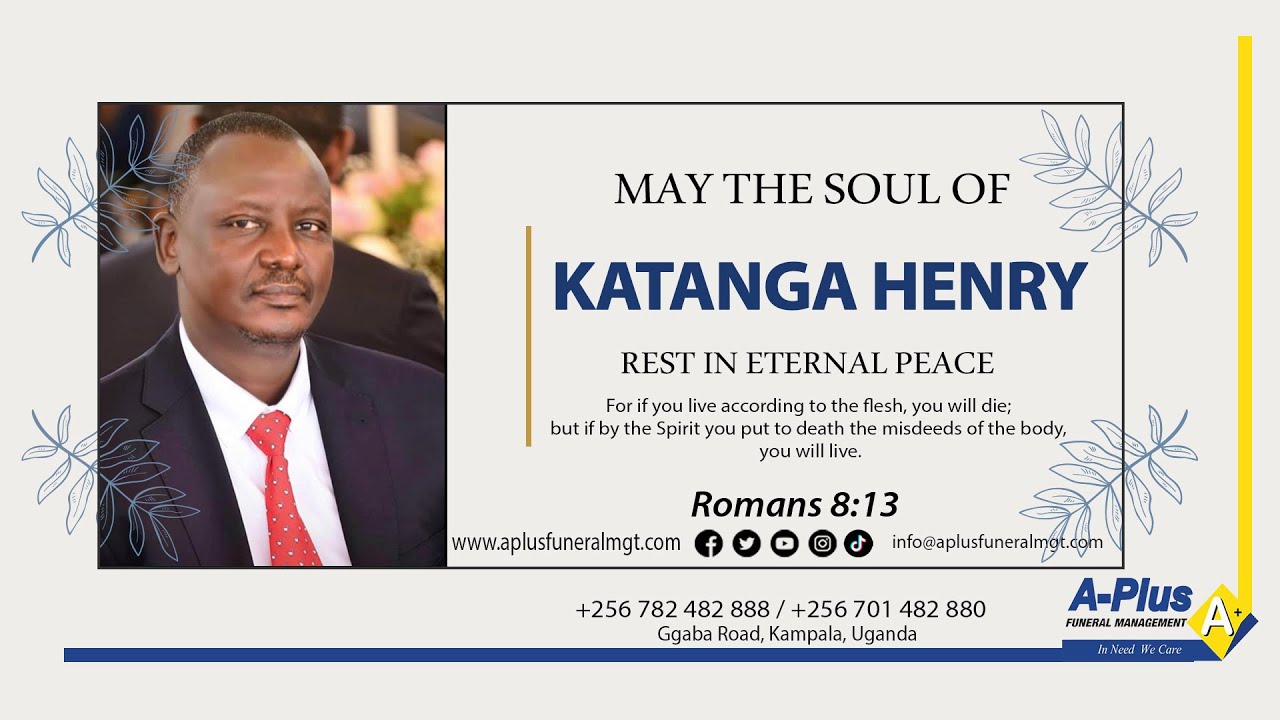

BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account

BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among