KAMPALA, Uganda: In a shocking turn of events, the controversial $32 million debt owed by businessman Patrick Bitature to his creditors at M/s Vantage Mezzanine Fund II Partnership has resurfaced, casting a shadow over his dealings with the government in the Electromaxx Thermal Plant acquisition. This exclusive report unveils how the contested debt has come back to haunt Bitature through a damning report authored by none other than the Auditor General, Mr. John Muwanga.

The Auditor General’s report, a comprehensive analysis of the technical, legal, and financial aspects of the Electromaxx Thermal Power Plant deal with the government, raises several red flags. The report explicitly cautions the government against proceeding with the purchase of the power plant, which is linked to Bitature, citing significant reasons including ongoing legal disputes and indebtedness surrounding the company.

“I noted that ELECTROMAXX is indebted to the tune of USD 13,978,900 and UGX.138,537,919 in regard to ascertained debts being taxed costs attendant to litigation; and unascertained debts of USD1,412,477.76 relating to pending or threatened litigations. These may cause an impediment on the ability of ELECTROMAXX to transfer facility assets to Government,” the Auditor General’s report states.

Among the alarming findings in the report, it is revealed that Electromaxx holds significant debts amounting to millions of dollars, both as ascertained and unascertained debts, stemming from various litigation processes. This precarious financial situation could potentially hinder the seamless transfer of facility assets to the government.

The report further emphasizes the need for a resolution of the outstanding debts between Electromaxx and the government during the decision-making process. Additionally, it highlights the tangled web of land ownership, particularly in relation to the thermal power plant’s location, which is subject to a mortgage with Absa Bank. “The settlement of the indebtedness of ELECTROMAXX in regard to litigations should be agreed between ELECTROMAXX and Government during the decision-making process,” the report notes. It also calls for clarity on land ownership and the resolution of the mortgage agreement with Absa Bank.

Furthermore, the report uncovers that Electromaxx had not acquired the necessary Petroleum Refinery License and had not complied with various required development permits, leading to potential legal and regulatory compliance risks. The background to this ordeal lies in Bitature’s attempts to alleviate his financial troubles. The businessman, who serves as the group CEO of Simba Group, sought government intervention to sell the Electromaxx Thermal Power Plant in Tororo District, Uganda, in a bid to address a $30-million debt owed to South African lender Vantage Capital.

However, the hoped-for bailout took a dramatic turn when the Auditor General’s report cast serious doubts on the feasibility of the power plant acquisition. The report highlighted critical issues such as debt burdens, legal disputes, and questionable land ownership. Bitature’s recent financial woes seem to have multiplied, with revelations of his failure to repay a $10-million investment from Vantage Capital, which has since ballooned to around $32 million. This situation has led to a legal battle over ownership of his assets as Vantage Capital seeks to recover the unpaid debt.

The situation escalated further when the International Chamber of Commerce Court of Arbitration in London ruled against Bitature, ordering him to repay the hitherto contested $35-million loan to Vantage Capital. The court ruling highlighted the complex nature of the dispute, stemming from Bitature’s alleged non-repayment of the loan. This recent turn of events has plunged Bitature into a whirlwind of pressure, causing his financial standing to deteriorate even further. The legal battles and unresolved financial obligations have put his reputation and business interests at stake, leaving him to navigate a precarious and uncertain future.

As Uganda grapples with these unfolding developments, questions linger about the fate of the Electromaxx Thermal Power Plant deal and Bitature’s ability to untangle himself from the web of debt and legal entanglements that now surround him. Watch the space…

Author Profile

- Stanley Ndawula is a two and a half decades’ seasoned investigative journalist with a knack for serious crimes investigations and reporting. He’s the Founding Editorial Director and CEO at The Investigator Publications (U) Limited

Latest entries

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma

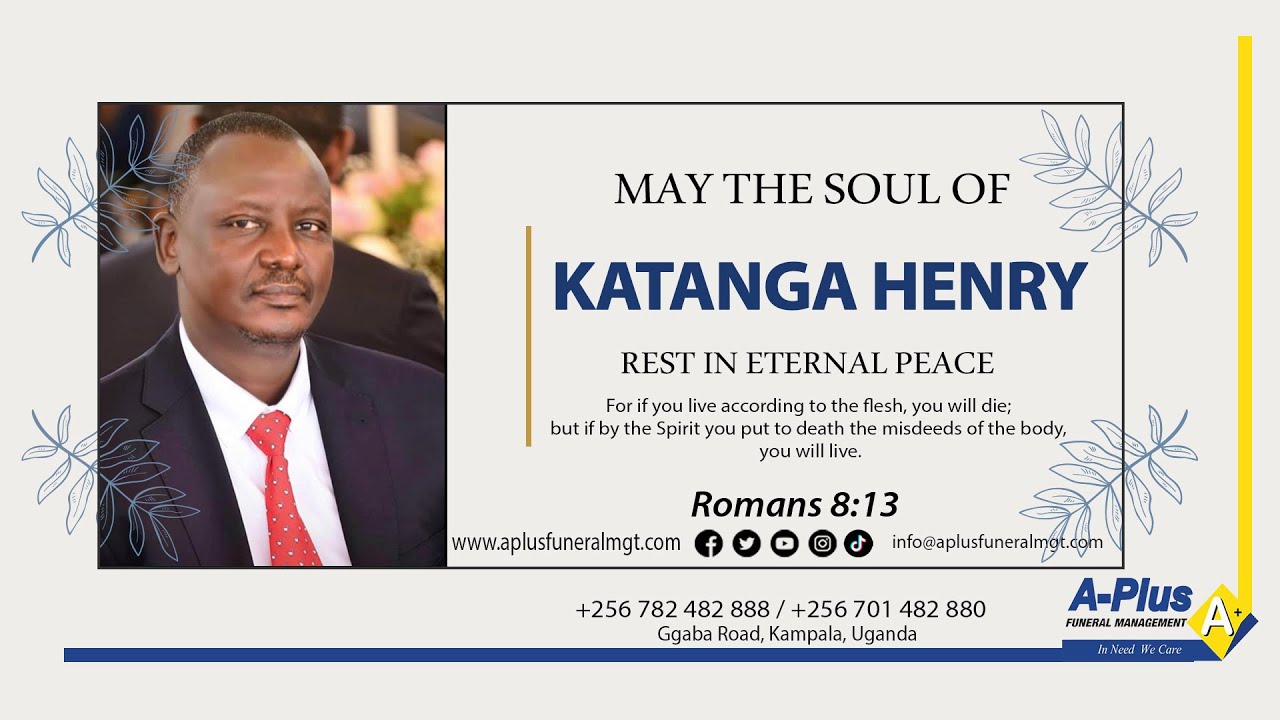

BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account

BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Why “shocking”?