KAMPALA, Uganda: In a stunning move to save city businessman Patrick Bitature from the jaws of a biting USD35M loan owed to South African Company Vantage Mezzanine Fund II, Uganda’s Cabinet has reportedly approved a colossal USD66M deal, equivalent to around UGX 240,900,000,000. This exclusive revelation comes to light courtesy of The Investigator, which has obtained insider information from the corridors of power.

A highly reliable source from within the government disclosed that Cabinet members convened on Monday and unanimously passed a cabinet paper to give the green light to a UGX240 billion deal favoring Bitature’s Electromaxx Thermal Plant purchase. Notably, it is believed that this deal was brokered by Bitature’s personal friend, State Minister for Privatization and Investment, Hon. Evelyne Anite.

If the deal, as obviously expected, is passed by Parliament, the well-connected businessman will have solved all his financial burdens and uncertainties that had put at stake, all his known livelihood! The deal, according to the cabinet paper snippets in our possession, is disguised in a purchase by government, of Bitature`s Electromaxx Thermal Plant premised in West Nile.

For starters, West Nile is a sub-region in northern Uganda, bordered by the Democratic Republic of Congo in the south and west, by South Sudan to the north and by the Albert Nile to the east. The largest town of West Nile is Arua, located 475 northwest of Kampala Capital. Here, Bitature`s Electromaxx has been, and still is charged with supplying power to the West Nilers.

It is this thermal plant that government has, against all odds, chosen to purchase, as a backup to the Umeme grid, but in total disregard of the Auditor General (AG)`s recommendation to the contrary. The AG, Mr. John Muwanga had based his advice on the heavily debt-impregnated Electromaxx, legal disputes and land issues surrounding the company repute. But to bail him out of the quagmire, government has ignored all for Bitature.

Patrick Bitature owes UDS35M to his creditors of M/s Vantage Mezzanine Fund II Partnership. His efforts to have it quelled by Ugandan Courts failed, leading to an arbitration court away, in London. Here, he also lost and was ordered to proceed and pay up. It is at this trying moment that Bitature was supposedly saved by his close friend Anite, who offered to resurrect and broker to conclusion, the Government-Electromaxx deal.

The Flashback

This deal had hit a snug when, the Auditor General advised government against it. In his report, the Auditor General offered a comprehensive analysis of the technical, legal, and financial aspects of the Electromaxx deal with the government, raising several red flags. The report explicitly cautioned government against proceeding with the purchase of the power plant, citing significant reasons including the hitherto ongoing legal disputes and indebtedness surrounding the company.

“I noted that Electromaxx is indebted to the tune of USD 13,978,900 and UGX.138,537,919 in regard to ascertained debts being taxed costs attendant to litigation; and unascertained debts of USD1,412,477.76 relating to pending or threatened litigations. These may cause an impediment on the ability of Electromaxx to transfer facility assets to Government,” read the report.

Also, it was revealed that Electromaxx held significant debts amounting to millions of dollars, both as ascertained and unascertained debts, stemming from various litigation processes. This precarious financial situation, suggested the AG, could potentially hinder the seamless transfer of facility assets to the government. He further stressed the need for a resolution of the outstanding debts between Electromaxx and the government during the decision-making process.

Additionally, he highlighted the tangled web of land ownership, particularly in relation to the thermal power plant’s location, which is still subject to a mortgage with Absa Bank. The AG further counseled that the settlement of the indebtedness of Electromaxx in regard to litigations should prior, be agreed between the company and Government during the decision-making process, just in case they insisted on entering the risky deal.

Muwanga also called for clarity on land ownership and the resolution of the mortgage agreement with Absa Bank. Furthermore, he uncovered that Electromaxx had not acquired the necessary Petroleum Refinery License and had not complied with various required development permits, leading to potential legal and regulatory compliance risks.

The background to this ordeal laid in Bitature’s attempts to alleviate his financial troubles. The businessman, who serves as the group CEO of Simba Group, sought government intervention by selling them the Electromaxx Thermal Power Plant, in a bid to address his debt owed to South African lender Vantage Capital.

However, the hoped-for bailout took a dramatic turn when the Auditor General’s report cast serious doubts on the feasibility of the power plant acquisition. The report highlighted critical issues such as debt burdens, legal disputes, and questionable land ownership. Bitature’s financial woes had multiplied, with revelations of his failure to repay a USD10M investment from Vantage Capital, which has since ballooned to around USD35M.

This situation led to a legal battle over ownership of his assets as Vantage Capital sought to recover the unpaid debt. The situation escalated further when the International Chamber of Commerce Court of Arbitration in London, ruled against Bitature, ordering him to repay the hitherto contested loan to Vantage Capital.

The court ruling highlighted the complex nature of the dispute, stemming from Bitature’s alleged non-repayment of the loan. This turn of events plunged Bitature into a whirlwind of pressure, causing his financial standing to deteriorate even further. The legal battles and unresolved financial obligations have since put his reputation and business interests at stake, leaving him to navigate a precarious and uncertain future.

But thank God, his minister friend Anite had yet un-played cards to her chest. And we can authoritatively confirm, the hitherto troubled gentleman is all smiles. However, as Uganda grapples with these unfolding developments, questions linger here at The Investigator, about whether Electromaxx will serve to the brim, its share of the bargain. Watch this space for the conditions under which the deal was approved, plus other details entailed therein.

Author Profile

- Stanley Ndawula is a two and a half decades’ seasoned investigative journalist with a knack for serious crimes investigations and reporting. He’s the Founding Editorial Director and CEO at The Investigator Publications (U) Limited

Latest entries

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner

BusinessApril 16, 2024Equity Bank Billions Heist: “Let Him Go…” DPP Tells Police to Let Loose Kenneth Onyango as CEOs Samuel Kirubi and Anthony Kituuka`s Comfort Grow Thinner BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma

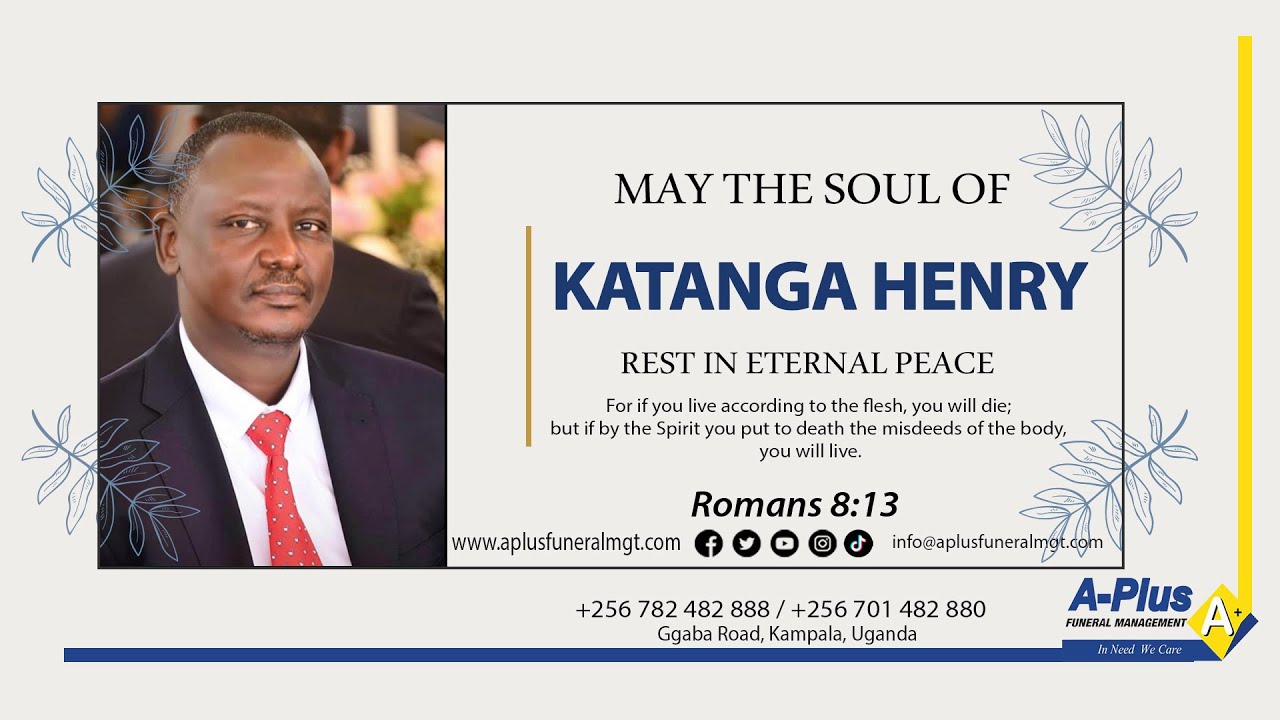

BusinessApril 10, 2024Equity Bank UGX65Bn Fraud Investigation: Resigned Executive Director Kenneth Onyango Finally Arrested as Former CEO Samuel Kirubi Sweats Plasma BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account

BusinessApril 1, 2024Four Months Down the Road: Henry Katanga Tragic Murder Unveils Tale of Greed and Betrayal as Bank Freezes UGX30Bn On Family Account Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Crime newsMarch 11, 2024Pay Back Moment: Bitter, Yet Jubilant Gen. Museveni Set to Summon Central Executive Committee Over His Heavily Exposed Speaker Rt. Hon. Anita Among

Have no problem with that bailout – especially for this fellow Ugandan investor – who employs thousands en thousands of youth. Compare with other tax incentive favored entrants that later takeoff after enjoying tax holidays.

We are watching all this.

Other people’s businesses have been forced to close with no baili-outs forth coming.