And the question is not how but why could the new Tax proposals on the alcoholic beverages lead to a decline in Gov’t revenues. The new tax proposals in the Excise Duty (Amendment) Bill 2024, once passed by Parliament, would make alcoholic beverages unaffordable to consumers, resulting in reduced volume sales, leading to a decline in annual tax revenues to the Government, according to alcoholic sector players.

The Uganda Breweries Managing Director Andrew Kilonzo says the expected increase in government revenue will not materialize as the 20% tax increase on both locally manufactured and imported spirits will make the products unaffordable to consumers, thus resulting in reduced volume sales.

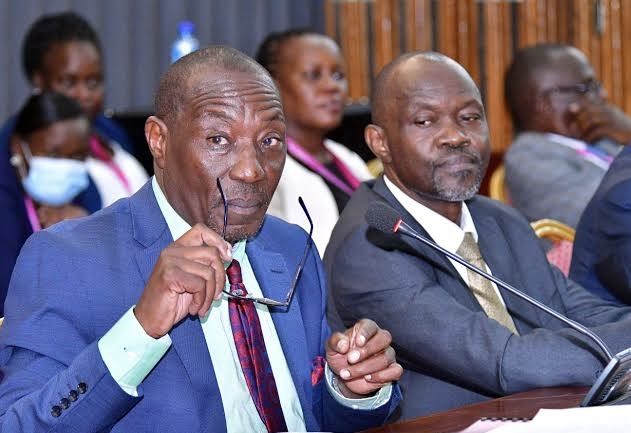

While interfacing with the Parliament’s Finance, Planning and Economic Development Committee which is scrutinizing the proposed tax bills for the next financial year, Kilonzo said an increase in taxes will lead to a decline in annual tax revenues to the Government of UGX. 49.7 billion from total industry and UGX 28.5 billion from Uganda Breweries

Citing Sub-clause 3(c) of the bill that imposes a tax of UGX 5,000 per liter on imported alcoholic beverages of alcoholic strength of 80%, Kilonzo narrates that the proposed 20% tax increase on both locally manufactured and imported spirits will also make legitimate products unaffordable to consumers who may resort to cheaper illicit and substandard products.

“This will lead to illicit trade as unscrupulous traders will take advantage of the extra incentive to evade tax and flood the markets with smuggled and illicit products at the expense of legitimate investors and further reduce Government revenue collections,” he stated. He proposed that imported alcoholic beverages of an alcoholic strength by volume of less than 80% be charged excise duty fee at a rate of 80% or UGX 1500 per litre, whichever is higher.

Jackie Tahakanizibwa, the Chairperson Uganda Alcohol Industry Association (UAIA) said that taxation measures should be focused on revising the economy, proposing among other things a shift from an “ad valorem” to a “specific” excise structure for spirits given the various benefits that the structure provides.

“We further request tax harmonization on ready-to-drink beverages with other locally produced beers based on alcohol content to allow for consumption of more locally grown raw materials like Pineapples and oranges,” she stated.

Uganda currently has the highest excise rates on spirits in the East African Community (EAC). With specific regard to imported spirits, Uganda’s excise duty rates are already almost twice as high as those of other East African Community (EAC) partner states.

Currently, Uganda’s Excise Duty on imported spirits per litre is 158% above Kenya, 266% above Tanzania and 53% above Rwanda. Due to high spirits excise rates in Uganda, the spirits growth rate in Uganda has been the lowest at 3.2% versus Tanzania at 26.3% and Kenya at 17.1%.

The proposed 20% increase from 80% to 100% on imported spirits will increase the per litre gap between Uganda and other EAC states, putting Uganda at 222% above Kenya, 357% above Tanzania, and 92% above Rwanda. This will have the effect of increasing parallel importation and smuggling from other EAC countries.

The Sheema Municipality MP (NRM) Dickson Kateshumbwa said it’s dangerous for Uganda to have the highest excise tax regime, as compared to other countries in East Africa, because it may lead to an increase in smuggling. “I want to invite members to clearly examine this. The matter that should concern us is that if you are a landlocked country like Uganda, it is dangerous to have the highest tax regime as compared to other peers in the region,” he stated.

Illicit alcohol:

Uganda is currently grappling with a problem of high levels of illicit trade in alcohol at 65% according to the Euromonitor study which was conducted in 2021. This often takes the form of undeclared production, counterfeiting and smuggling of products from neighboring countries.

The 2021 Euromonitor study also revealed that whereas the total market size for alcohol has grown by a 9.1% Compound Annual Growth Rate (CAGR) from 2017 to 2021, the size of the illicit (unregistered and untaxed) sector has grown by 17% CAGR in the same period.

Author Profile

- Mr. Daniels N. Tatya is an affluent Sports Writer, Commentator and Editor. His over 15 years of covering almost major sporting events makes him a revered and an authority on investigative Sports journalism in Uganda. He can also be reached via [email protected] +256(0)758268315

Latest entries

BusinessMay 20, 2024Charles Musekuura: A Disgrace In-law Who Borrowed UGX400M from His Supposed Brother Desh Kananura and Delivered a Condemned Wetland Instead of a Usable Land

BusinessMay 20, 2024Charles Musekuura: A Disgrace In-law Who Borrowed UGX400M from His Supposed Brother Desh Kananura and Delivered a Condemned Wetland Instead of a Usable Land BusinessMay 2, 2024Pay Up Already: High Court Orders Chinese Construction Firm and a City Engineer to Cough Over UGX6 Billion into Muwema and Company Advocates` Coffers

BusinessMay 2, 2024Pay Up Already: High Court Orders Chinese Construction Firm and a City Engineer to Cough Over UGX6 Billion into Muwema and Company Advocates` Coffers BusinessApril 30, 2024From The Best Mode to The Beast Mode: Reckoning the Future and Striking a Balance for New Tax Proposals on Alcoholic Beverages

BusinessApril 30, 2024From The Best Mode to The Beast Mode: Reckoning the Future and Striking a Balance for New Tax Proposals on Alcoholic Beverages FeaturedMarch 29, 2024Peace Guys – Peace…! Kabaka Ronald Muwenda Mutebi Rises to Calm Down His Warring Subjects Mpuuga and Ssentamu But A Little Too Late He Was

FeaturedMarch 29, 2024Peace Guys – Peace…! Kabaka Ronald Muwenda Mutebi Rises to Calm Down His Warring Subjects Mpuuga and Ssentamu But A Little Too Late He Was